Health Insurance Simplified

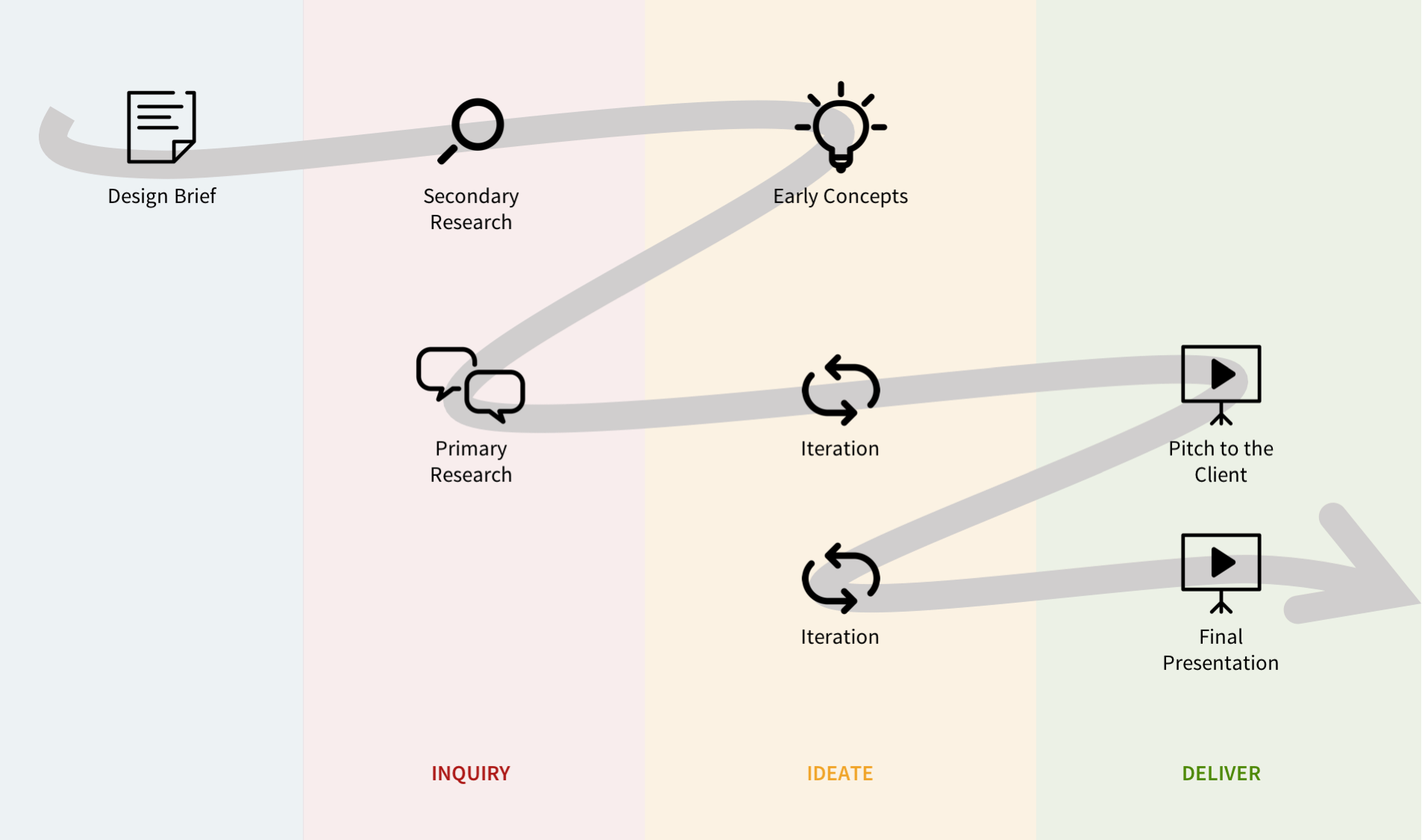

October 2016 | 2 weeks | Academic project for Design Strategy

CLIENT A third-party administrator for health insurance

TEAM AnnaRose Girvin | Daniel Newman | Rishabh Bhardwaj | Myself

MY ROLE User Research | Ideation | Prototyping

Overview

THE ASK

A better Explanation of Benefit

Our client administers health plans on behalf of companies that self-fund their employee’s health benefit. They process claims and provide customer service to members. An excellent member experience makes our client stand out from other third-party administers.

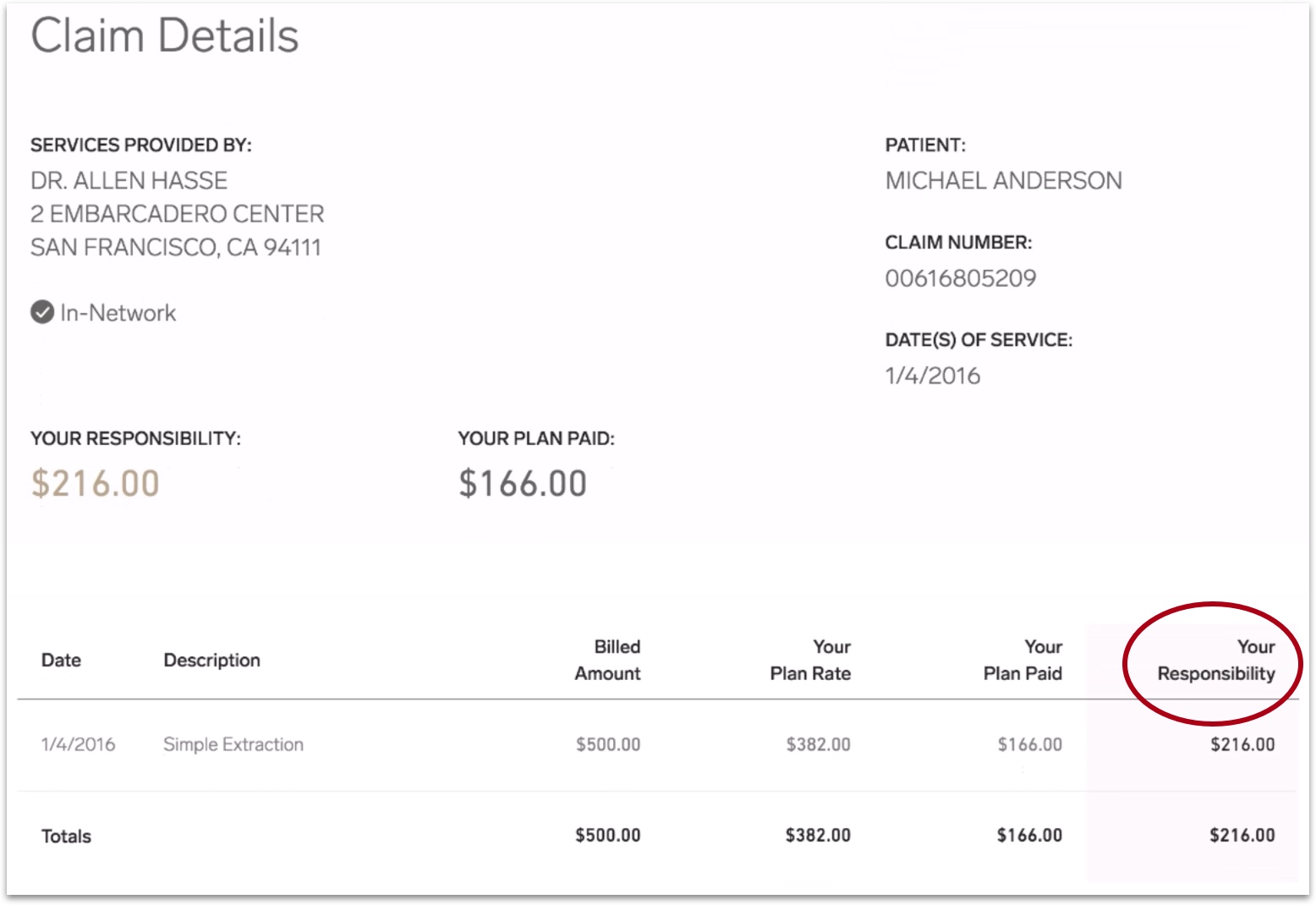

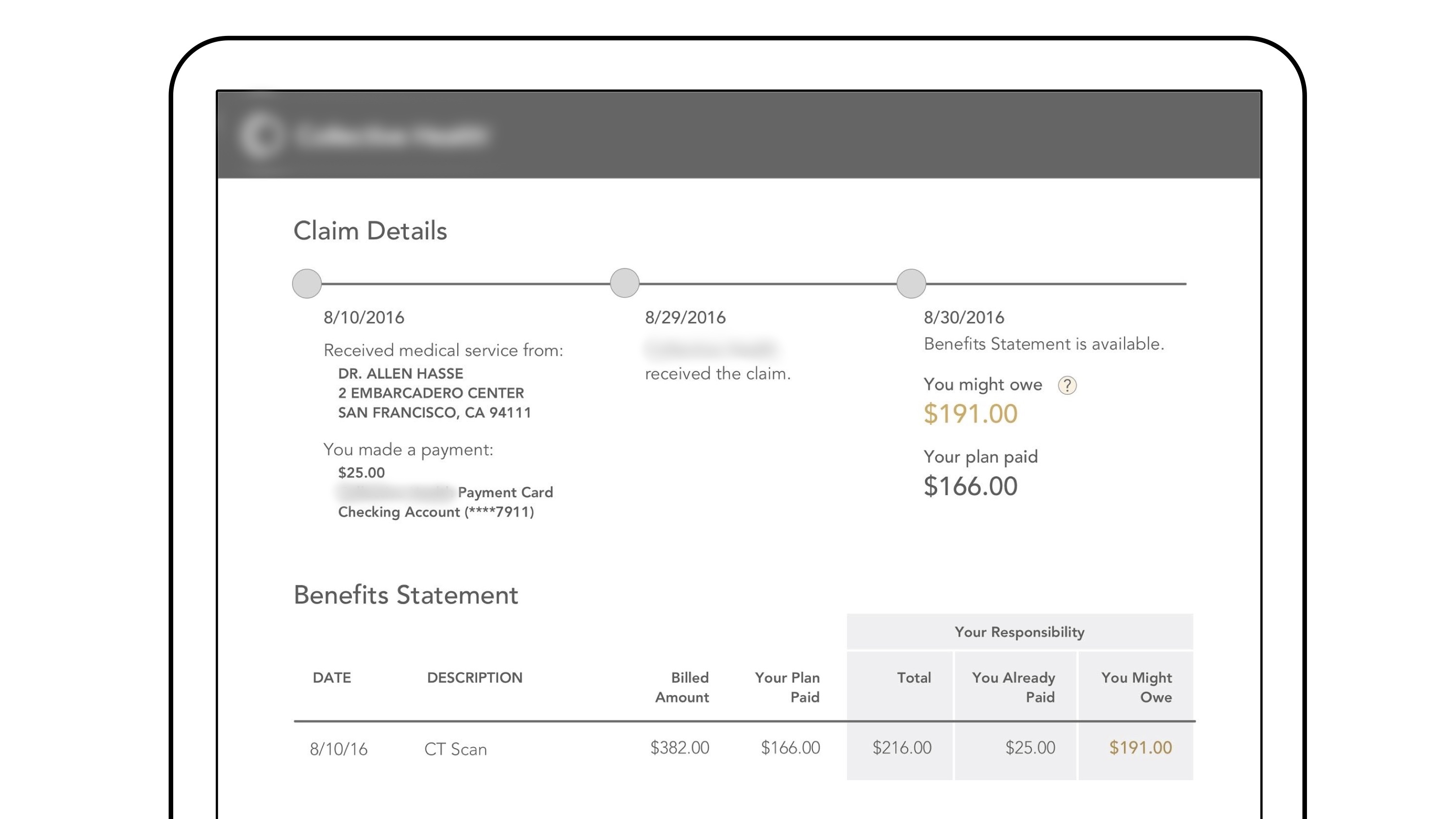

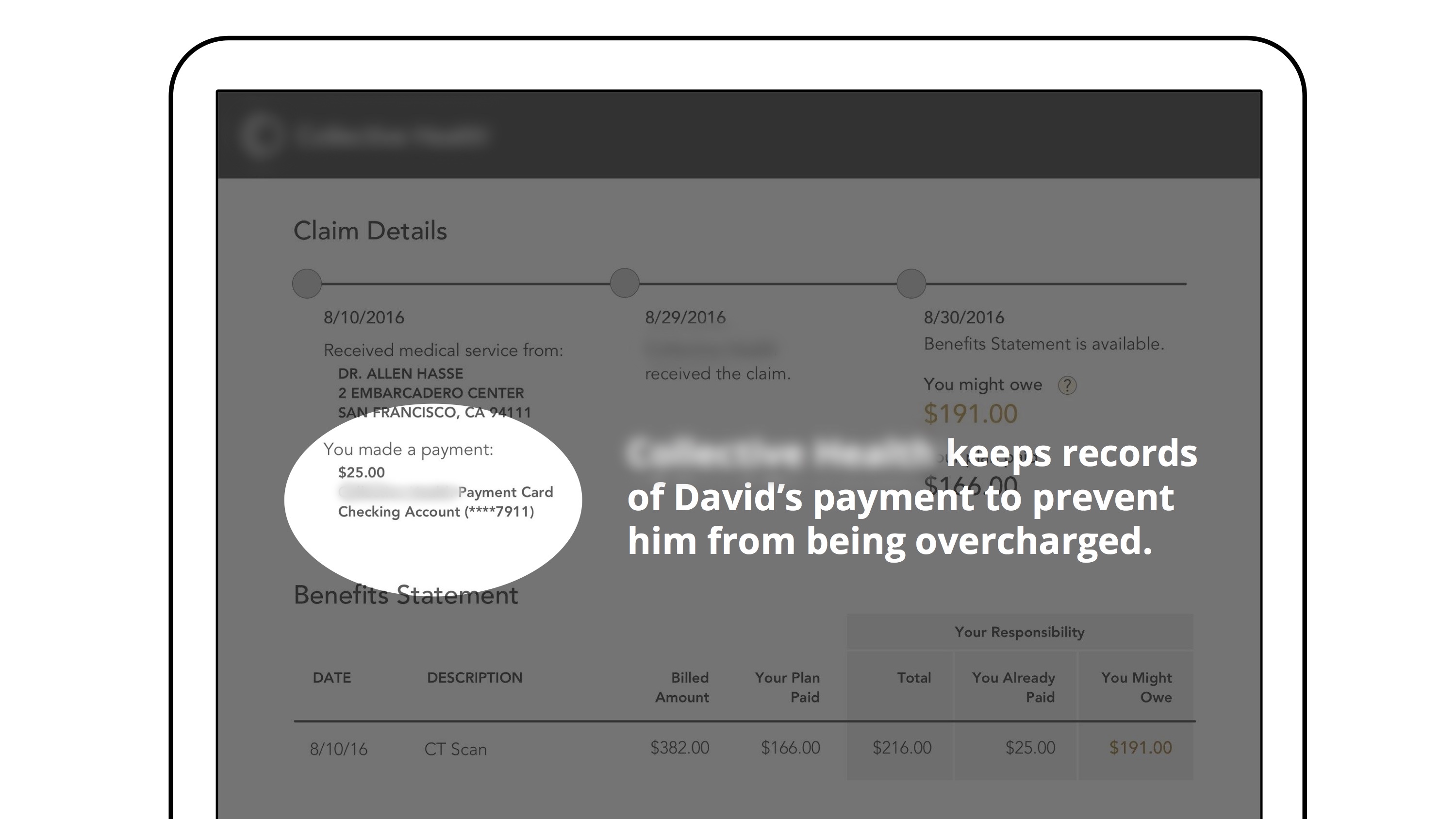

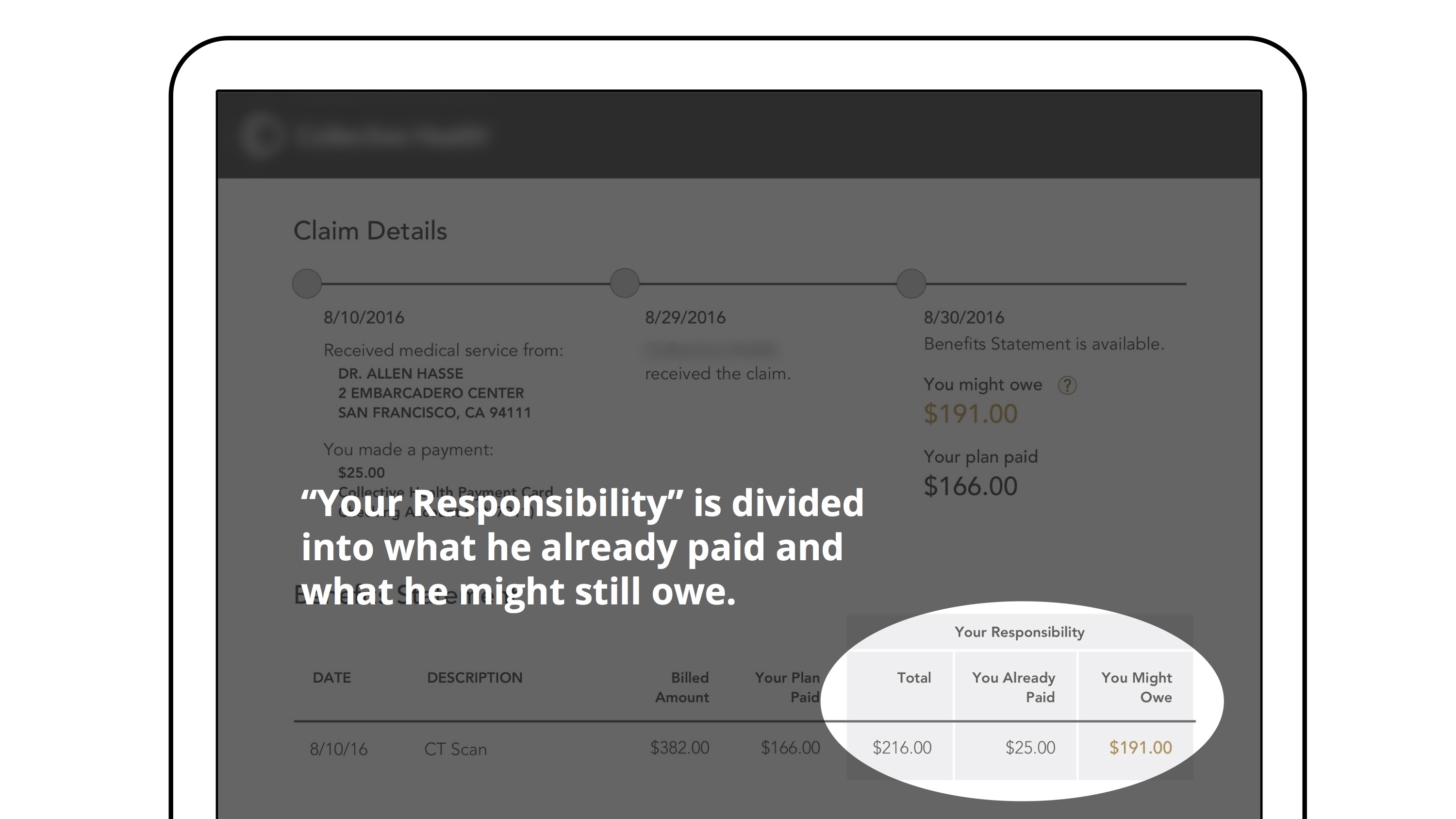

Our client wanted to design a better way for members to understand what they owe and what they have paid for their care.

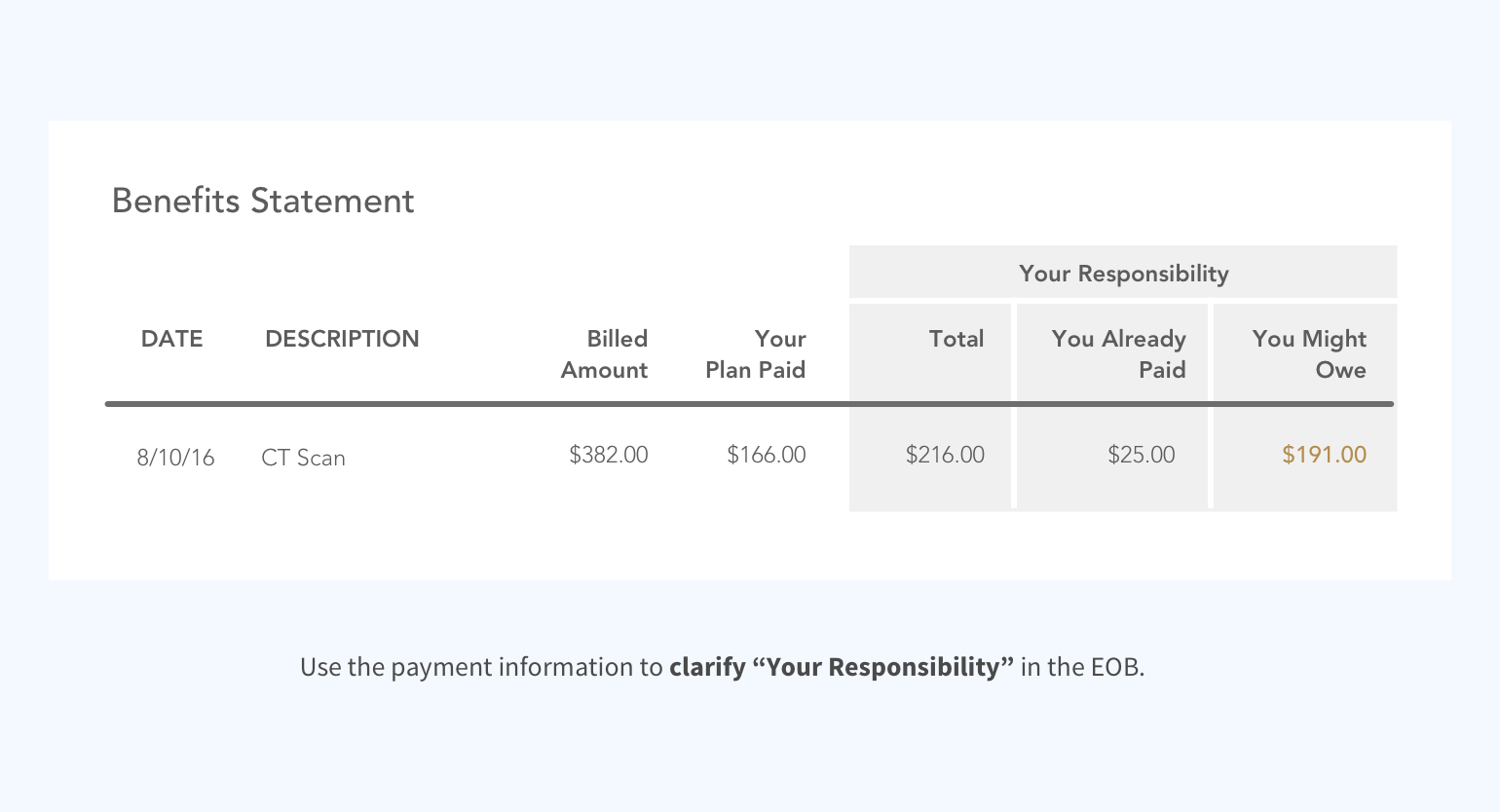

Currently, in the Explanation of Benefit (EOB), “Your Responsibility” shows the amount that isn't covered by the insurance, but it doesn’t tell the member exactly how much he/she still owes the doctor. How can we clarify this for members?

Understand the Experience

Knowing how much the member has paid during a visit is the key

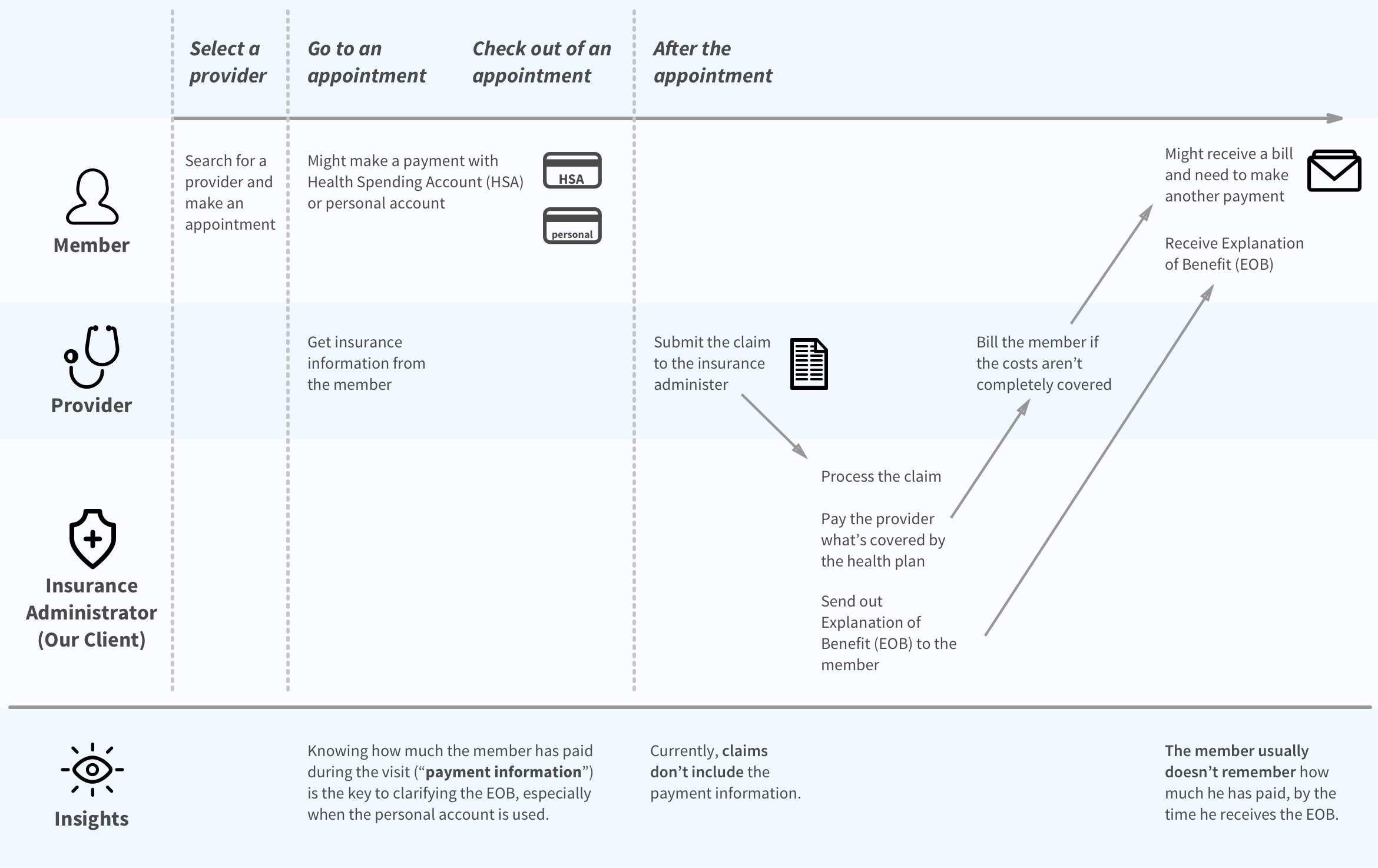

As a team, we created this journey map together to unify our understanding of the member experience and painpoints during a medical event, based on our conversations with the client, our secondary research, and inevitably our personal experience.

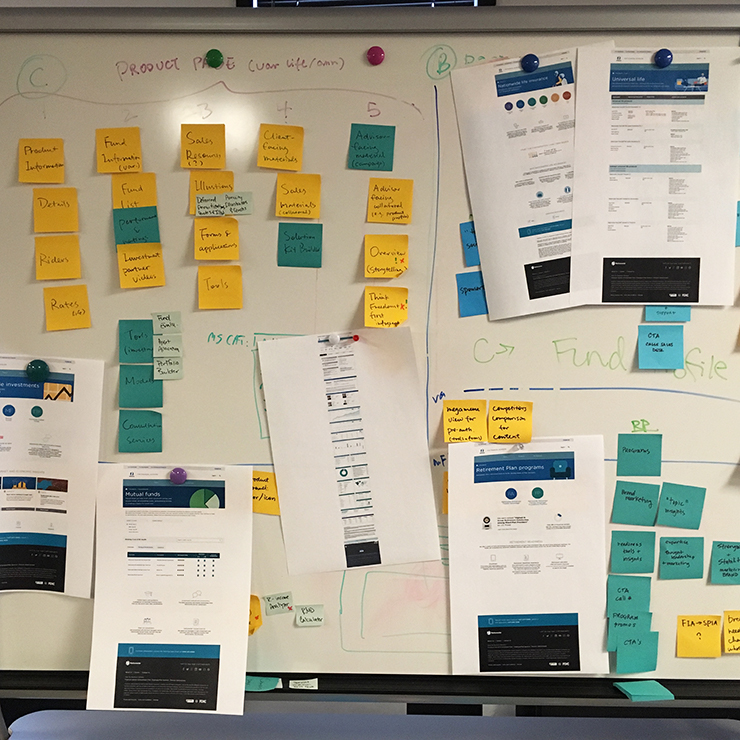

Understand the Healthcare Industry

We need to obtain the payment information without threatening the providers network or burdening the members

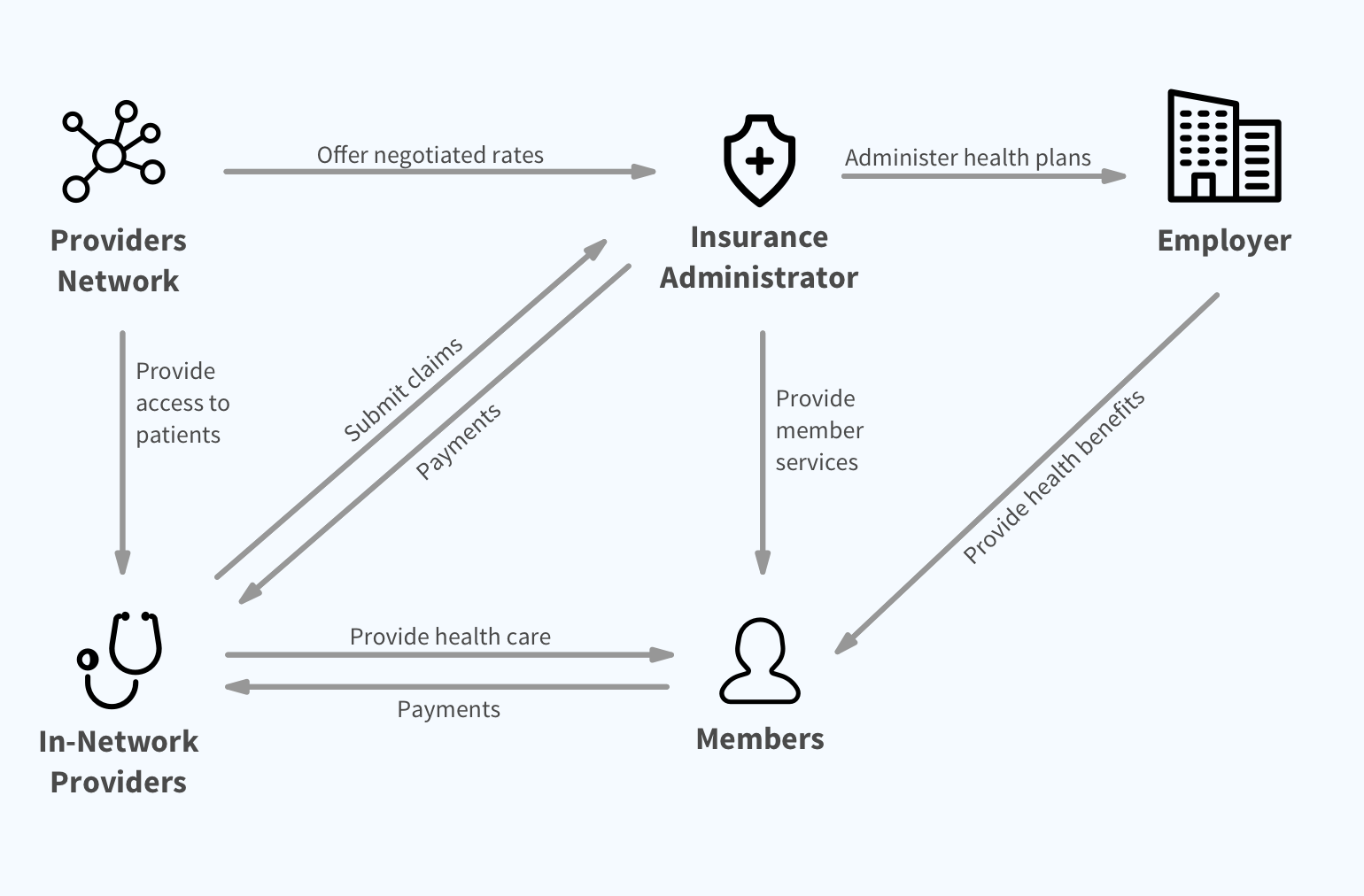

Before we start thinking about solutions, we want to first understand the bigger picture of the healthcare industry, so we created this stakeholders map to comb through the relationships between major players.

What we learned from the stakeholders map

Providers are not obligated to provide payment information to the insurance administrator, and it’s unlikely that any incentives will make them do so.

The insurance administrator relys on the providers network for connections with providers, and can't afford to lose the core partnership.

The insurance administrator needs to rely on members for their payment information, but putting the burden on members hurts the member experience.

Early Concepts

We started ideating as soon as we had a basic understanding of the problem and constraints:

the insurance administrator needs to get the payment information from members, without burdening them.

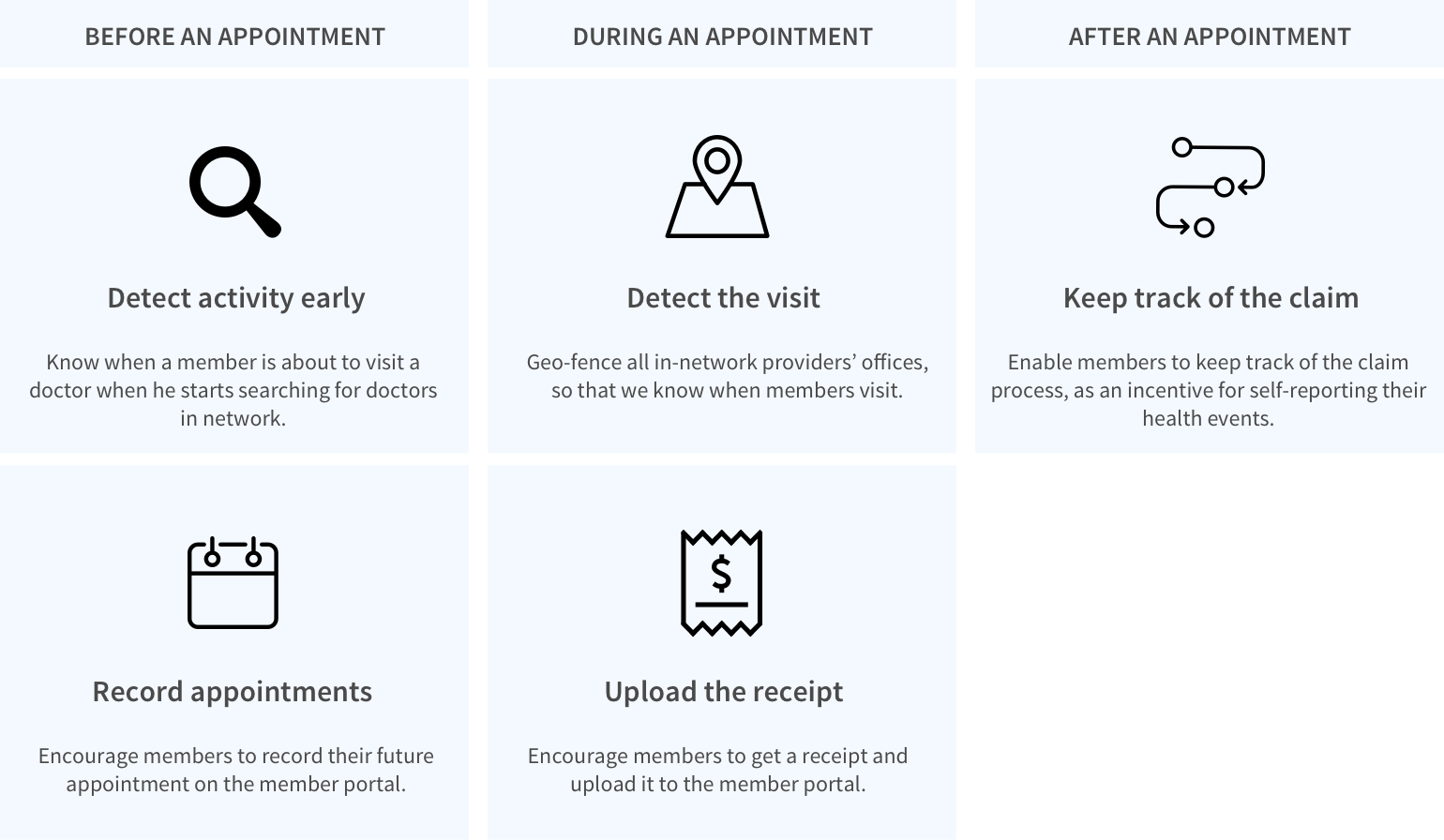

Concept A — Self-Report Health Events

Trying to encourage members to self-report their doctor’s office visit or any health events, we looked into all the touch points in the journey map again and thought about how we can detect their activities, prompt them to self-report at the right moments, and provide adequate incentives.

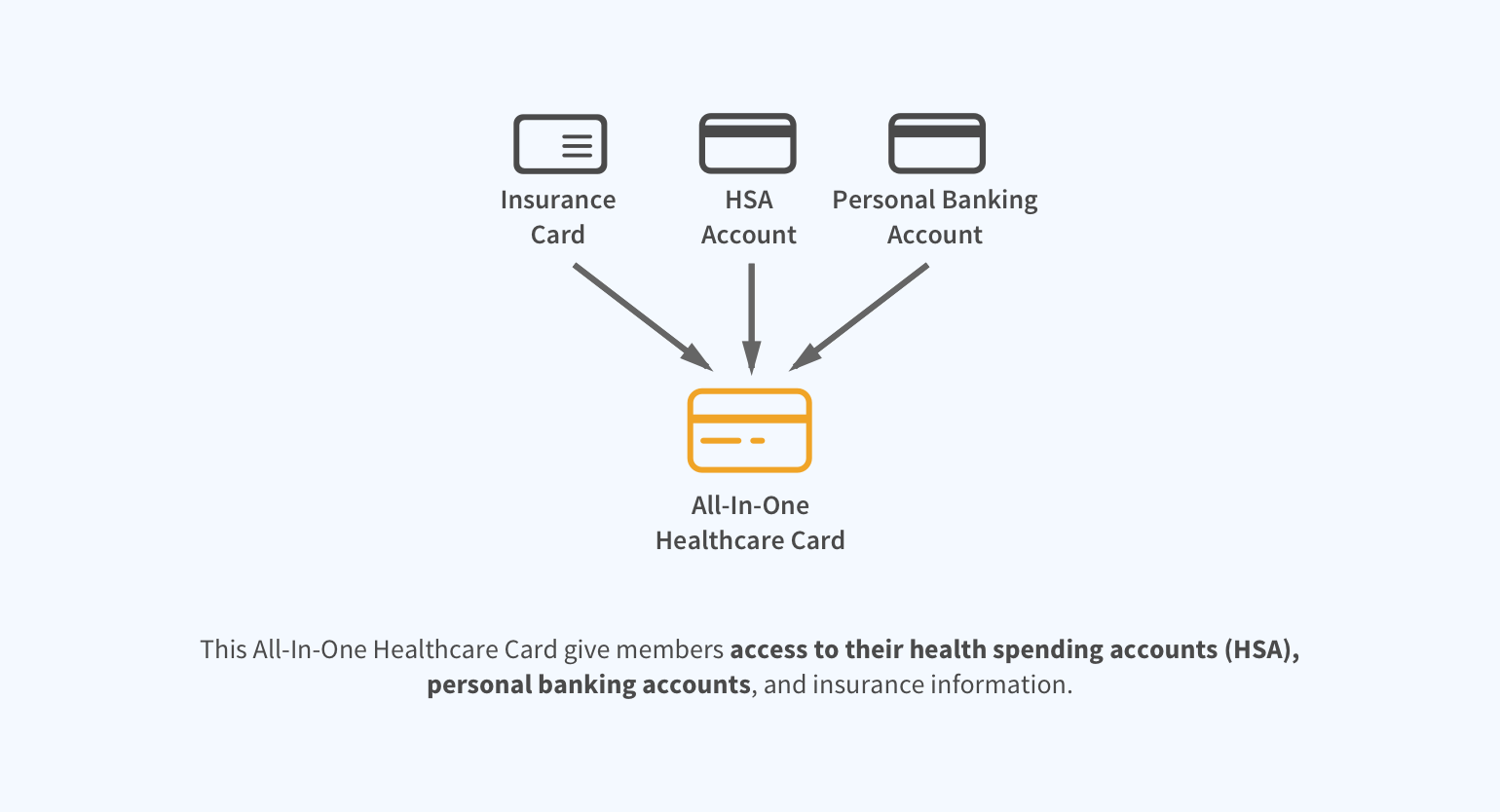

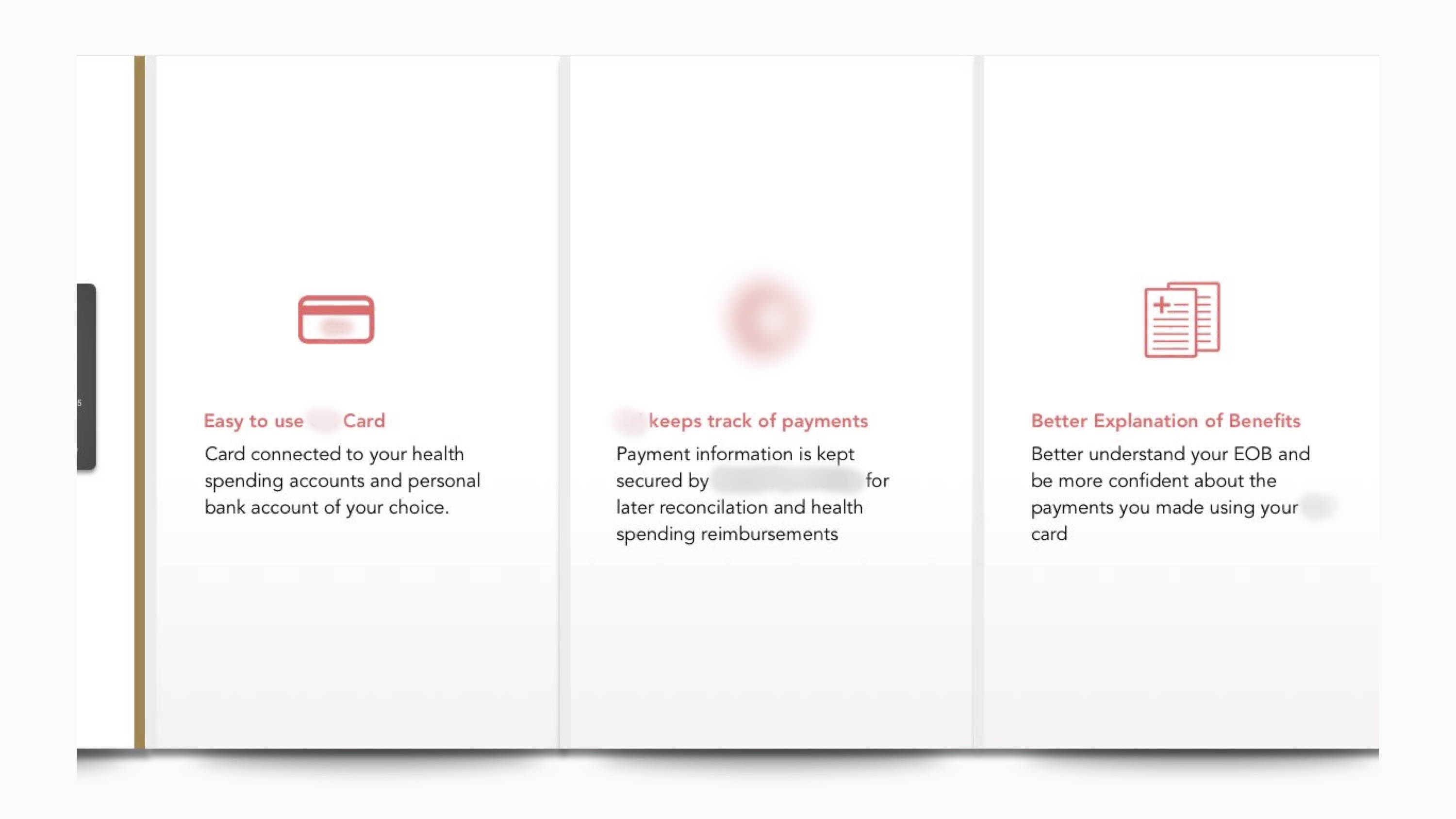

Concept B — All-In-One Healthcare Card

The biggest drawback of Concept A is that self-reporting requires extra efforts from members. With Concept B, we want to reduce the extra efforts to the minimum.

Interviewing the stakeholders

During the early stage of exploring the problem space and solutions, we knew we had made lots of assumptions. Now we wanted to validate these assumptions by talking to the stakeholders.

We interviewed...

Dani

Health Insurance Customer Service Representative, also a HSA holder

Kevin

Kidney Transplant survivor, has two health insurance policies, also a HSA holder

We showed Dani and Kevin our journey map, and asked them to fill in any information or painpoints that we missed. We also walked them through our early concepts, and discussed why these concepts might or might not work.

Insights from the interviews

Iteration: Based on Interview Insights

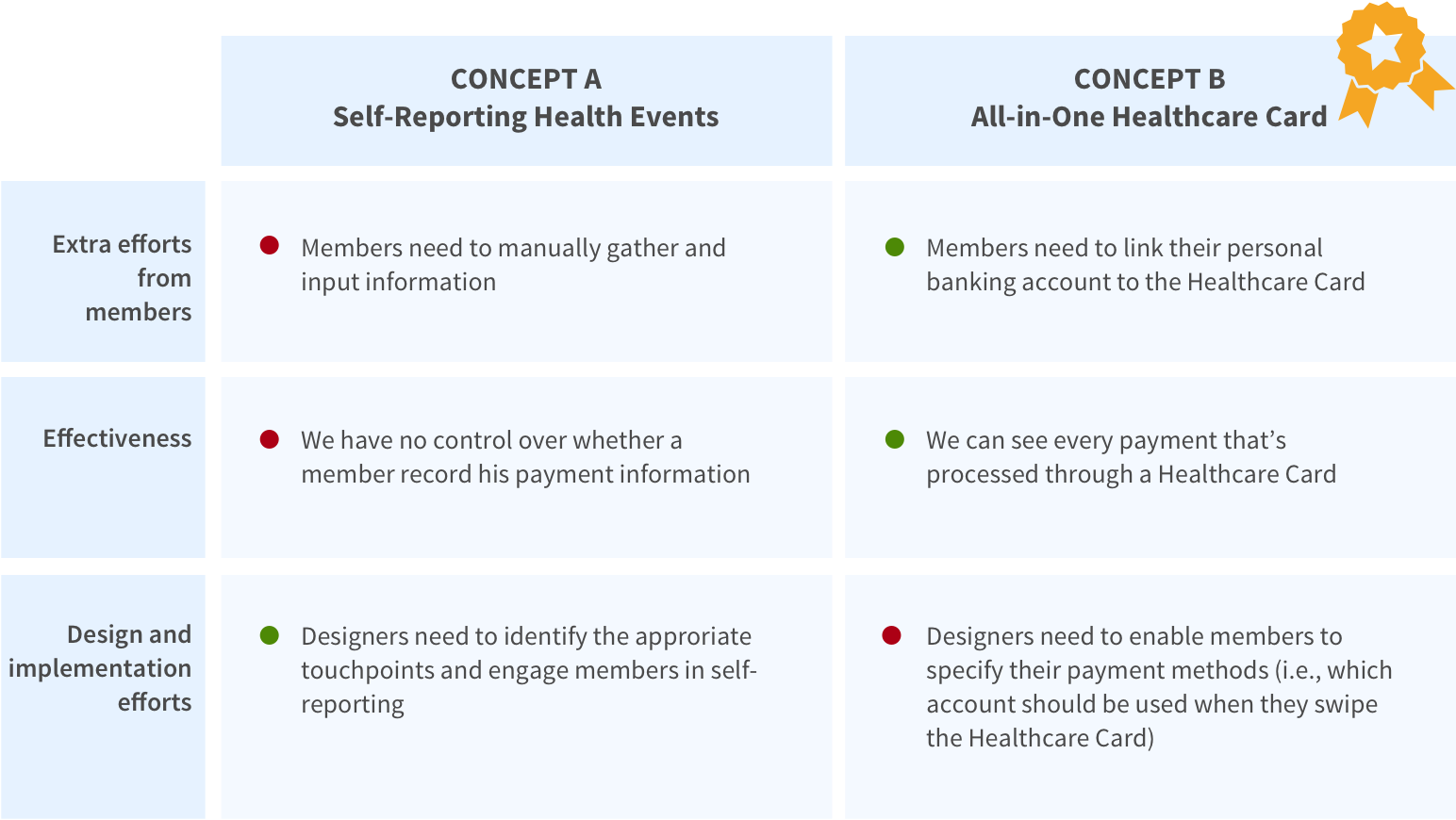

After extracting insights from the interviews, we decided to focus on developing Concept B and keep Concept A as supporting features.

Focusing on Concept B (All-in-One Healthcare Card)

Given limited time, we couldn’t afford to further develop both concepts. We made a comparison between the two and found Concept B to be more effective and providing a smoother member experience.

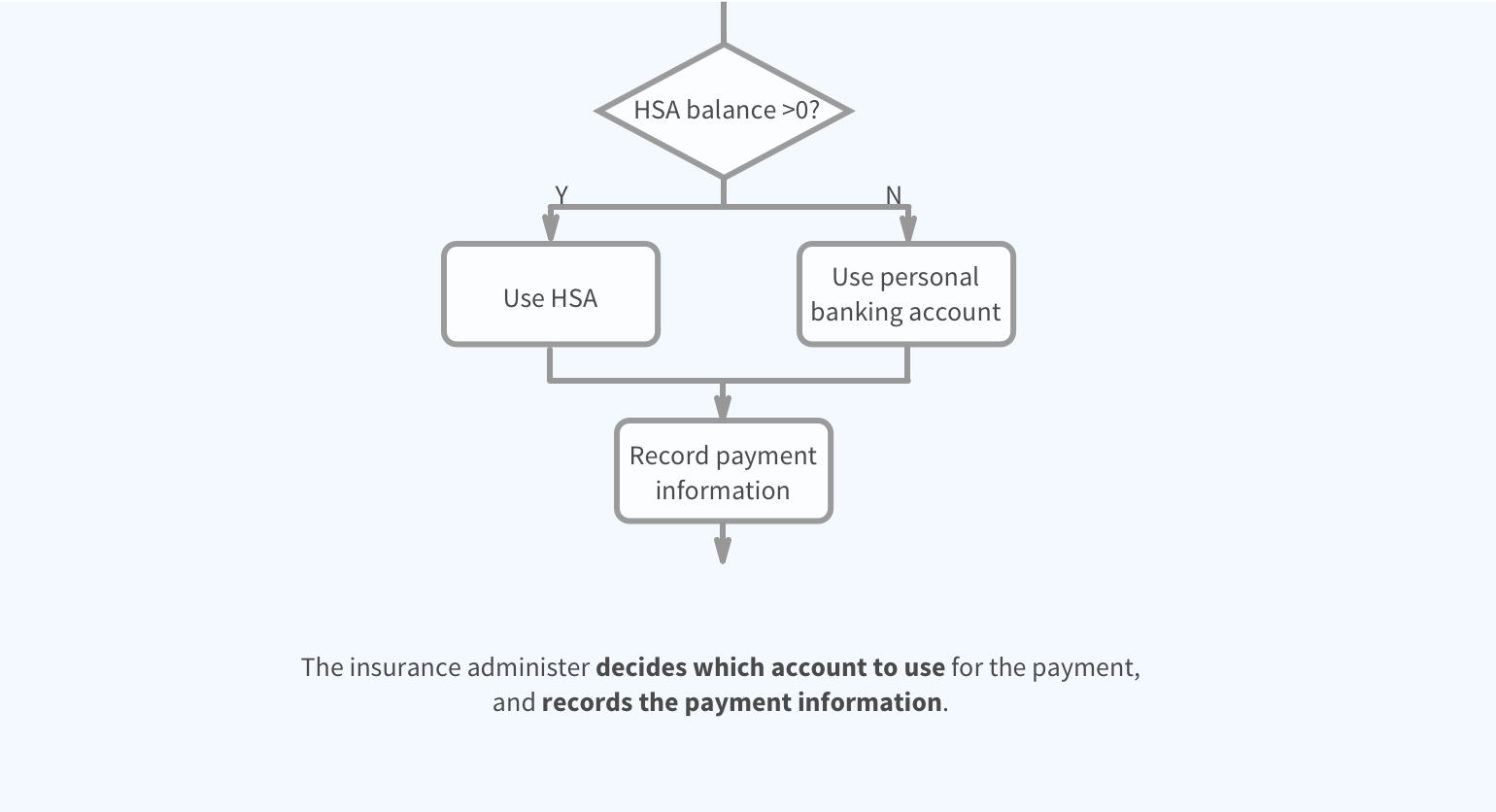

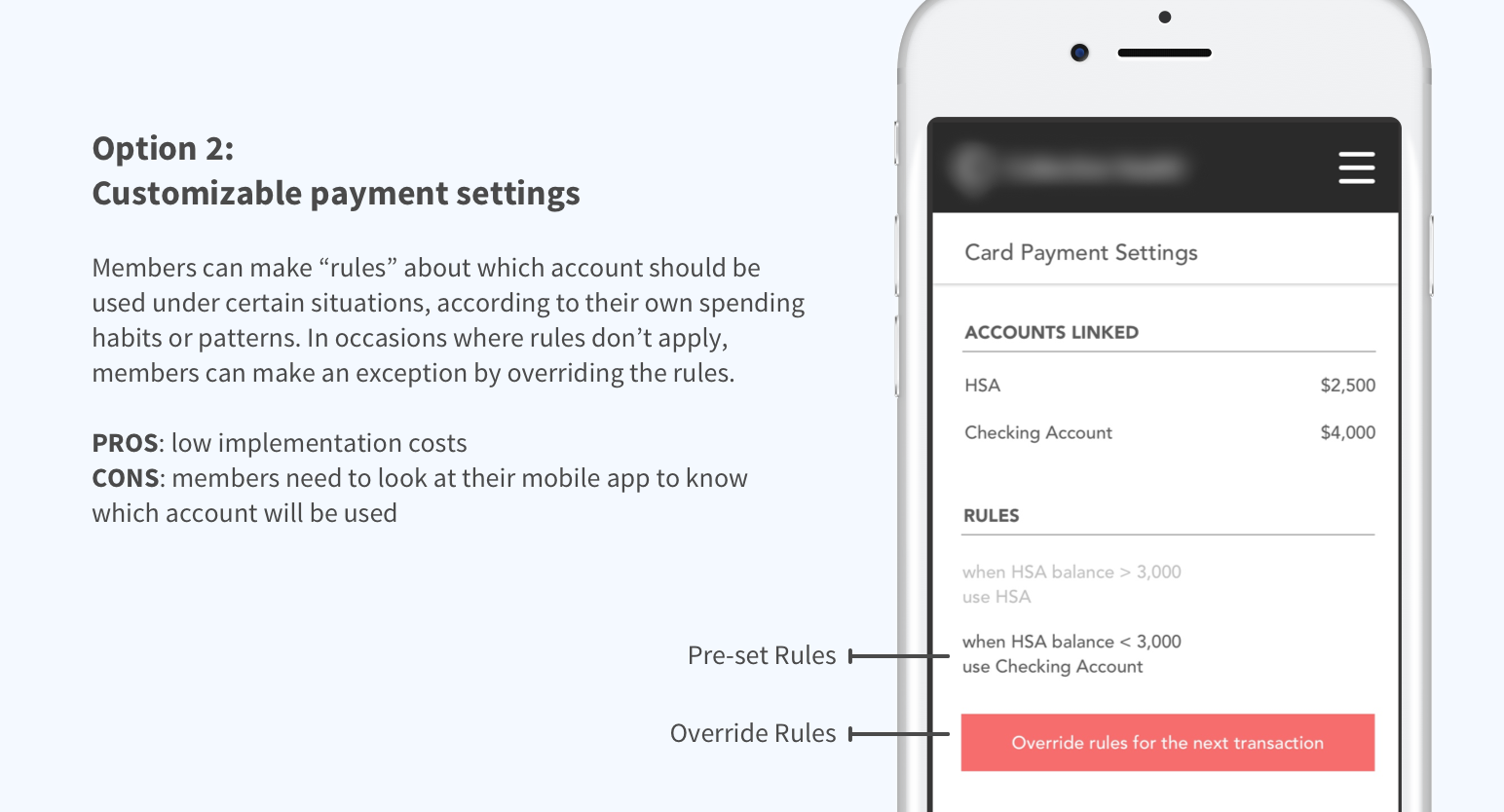

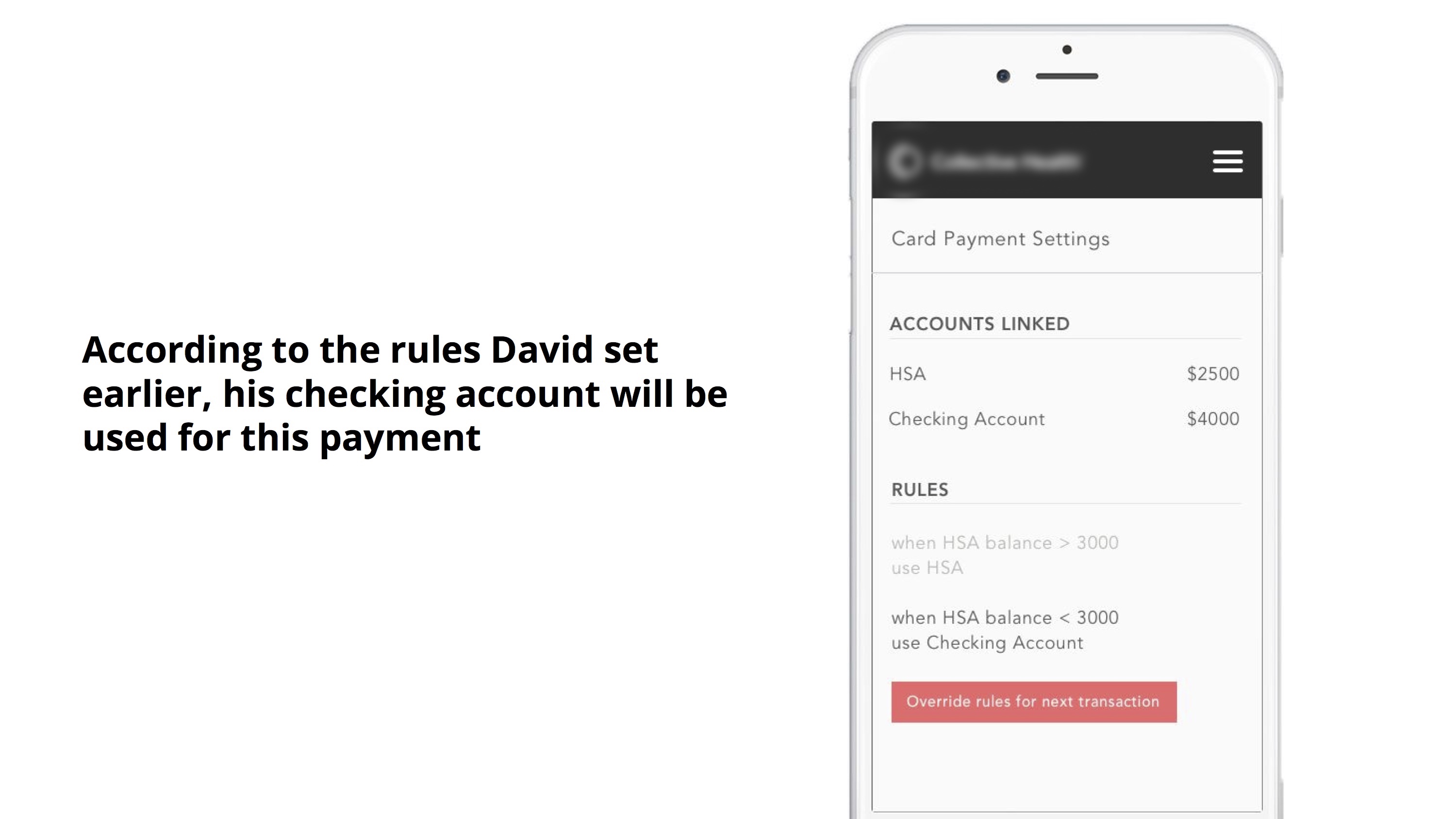

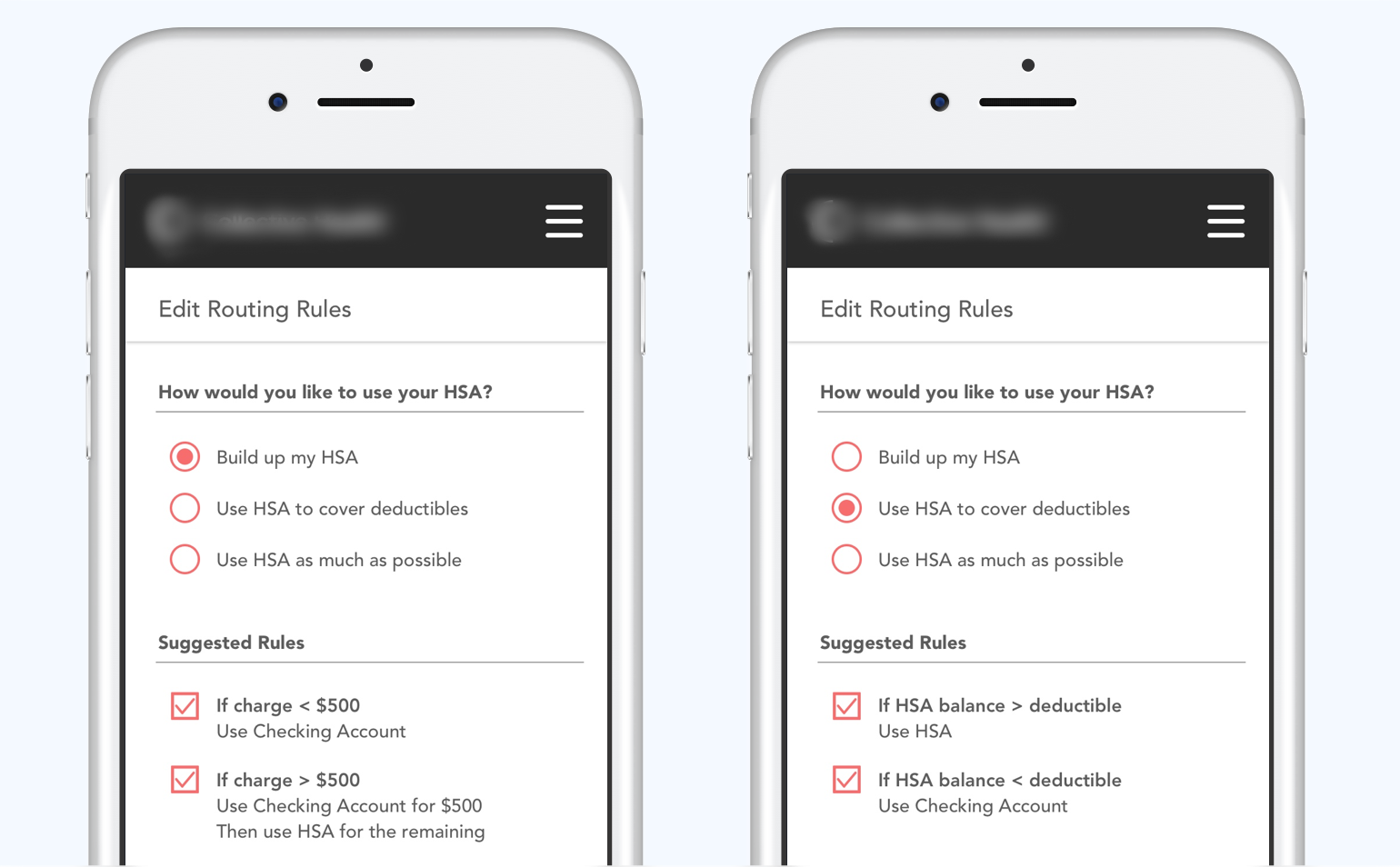

Specifying payment methods

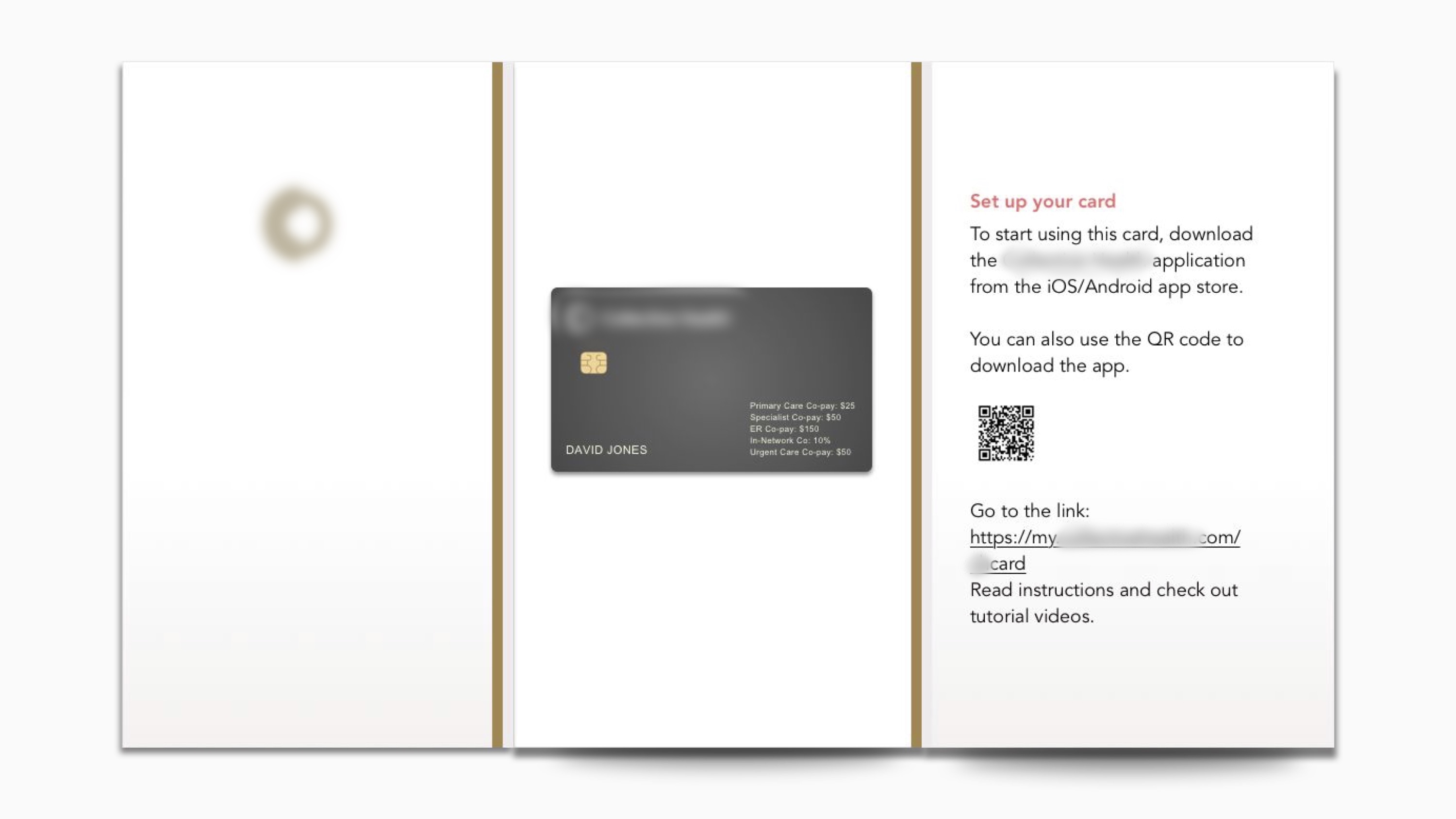

Healthcare Card lets members access both their HSA and checking account, but how can they specify which account to be used for each transaction? How can they know which account will be used during an transaction?

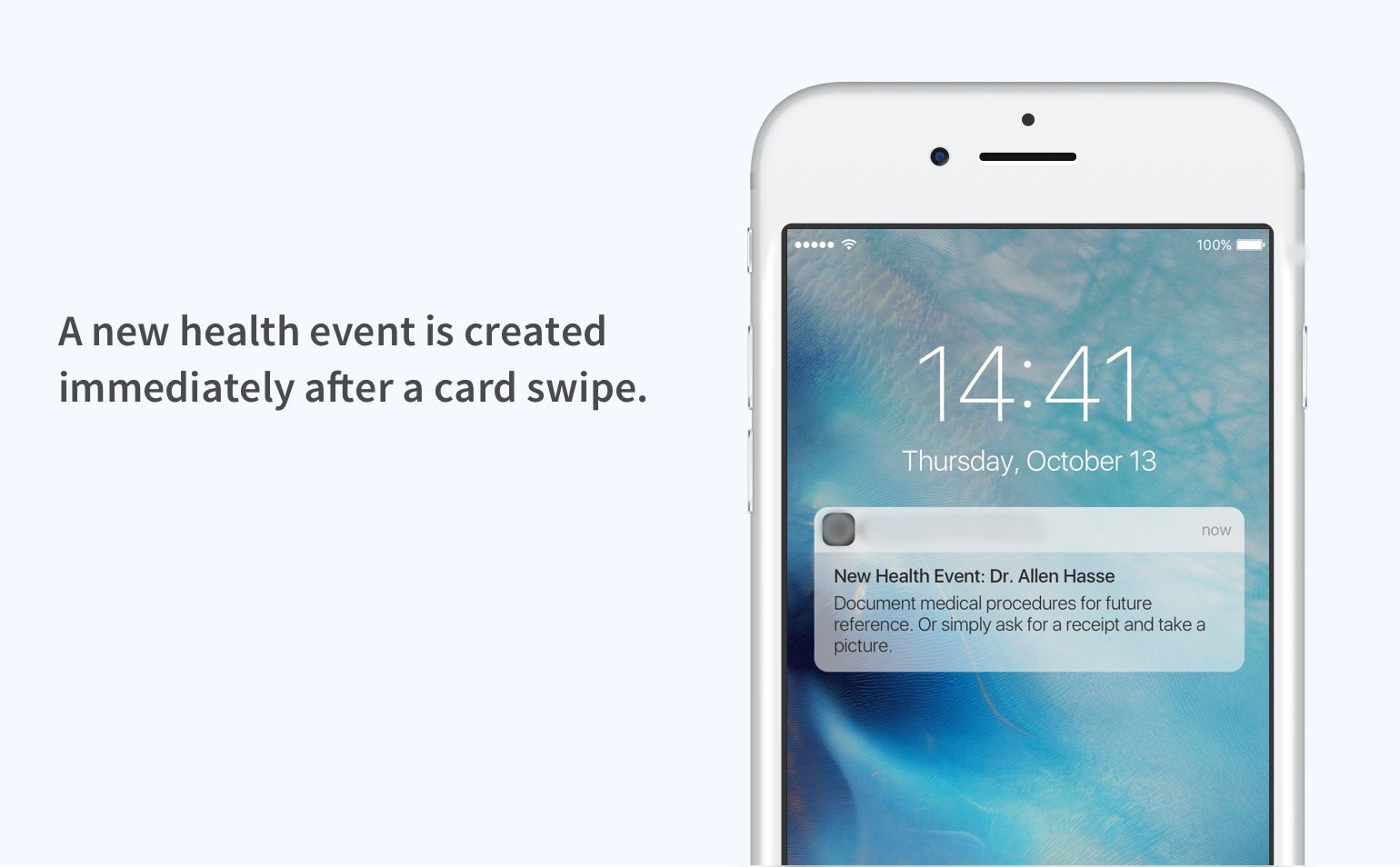

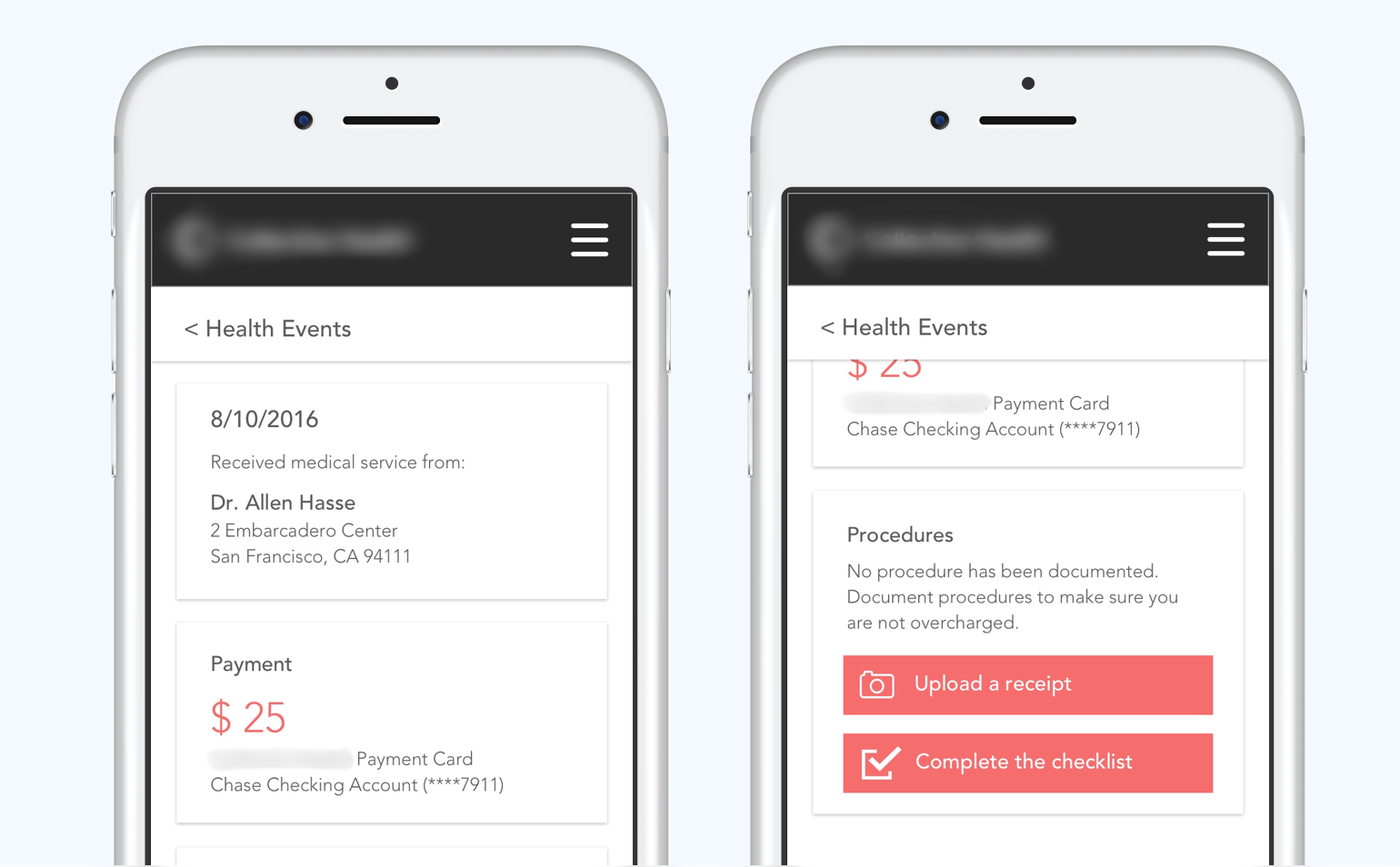

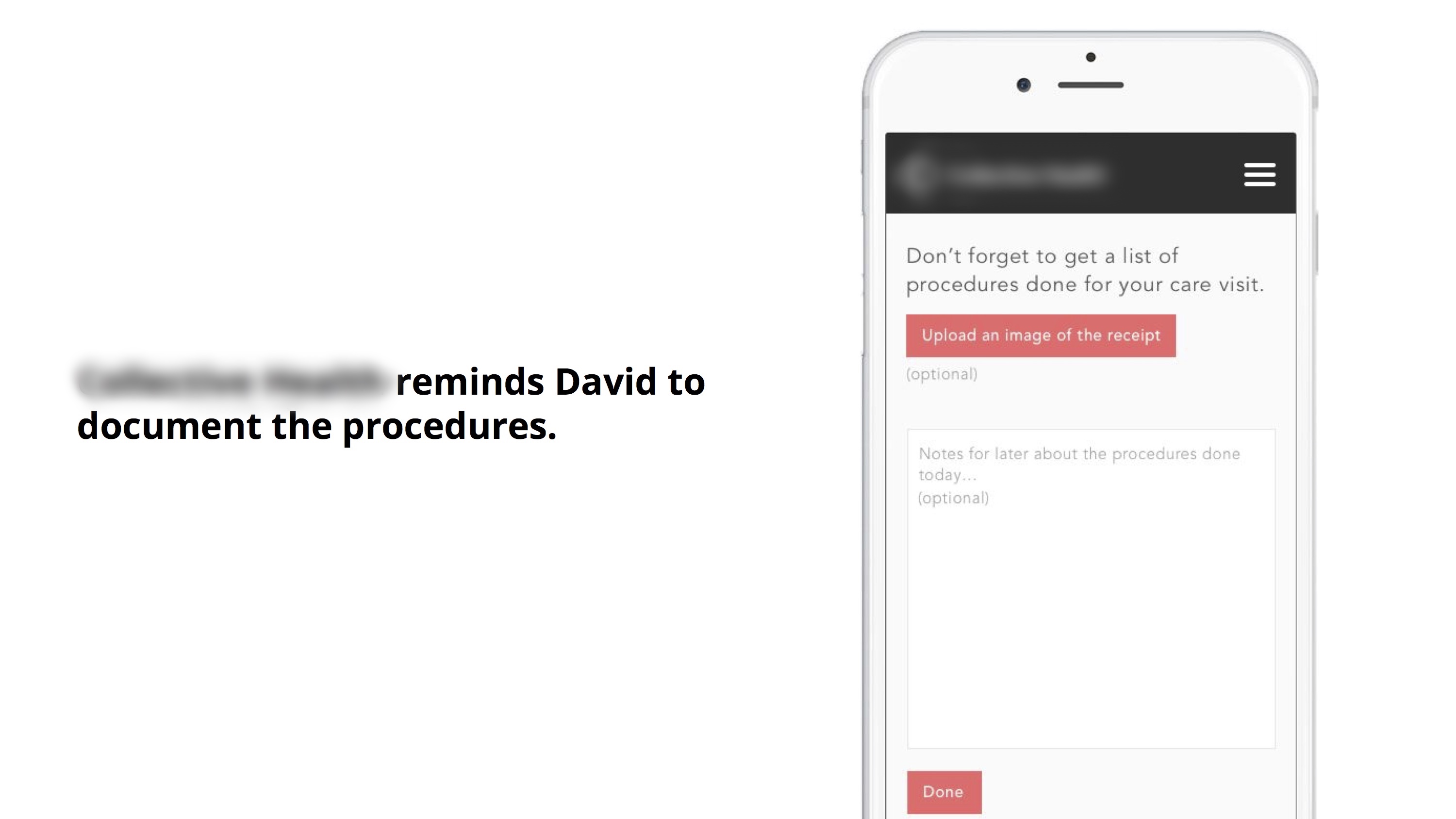

Documenting medical procedures

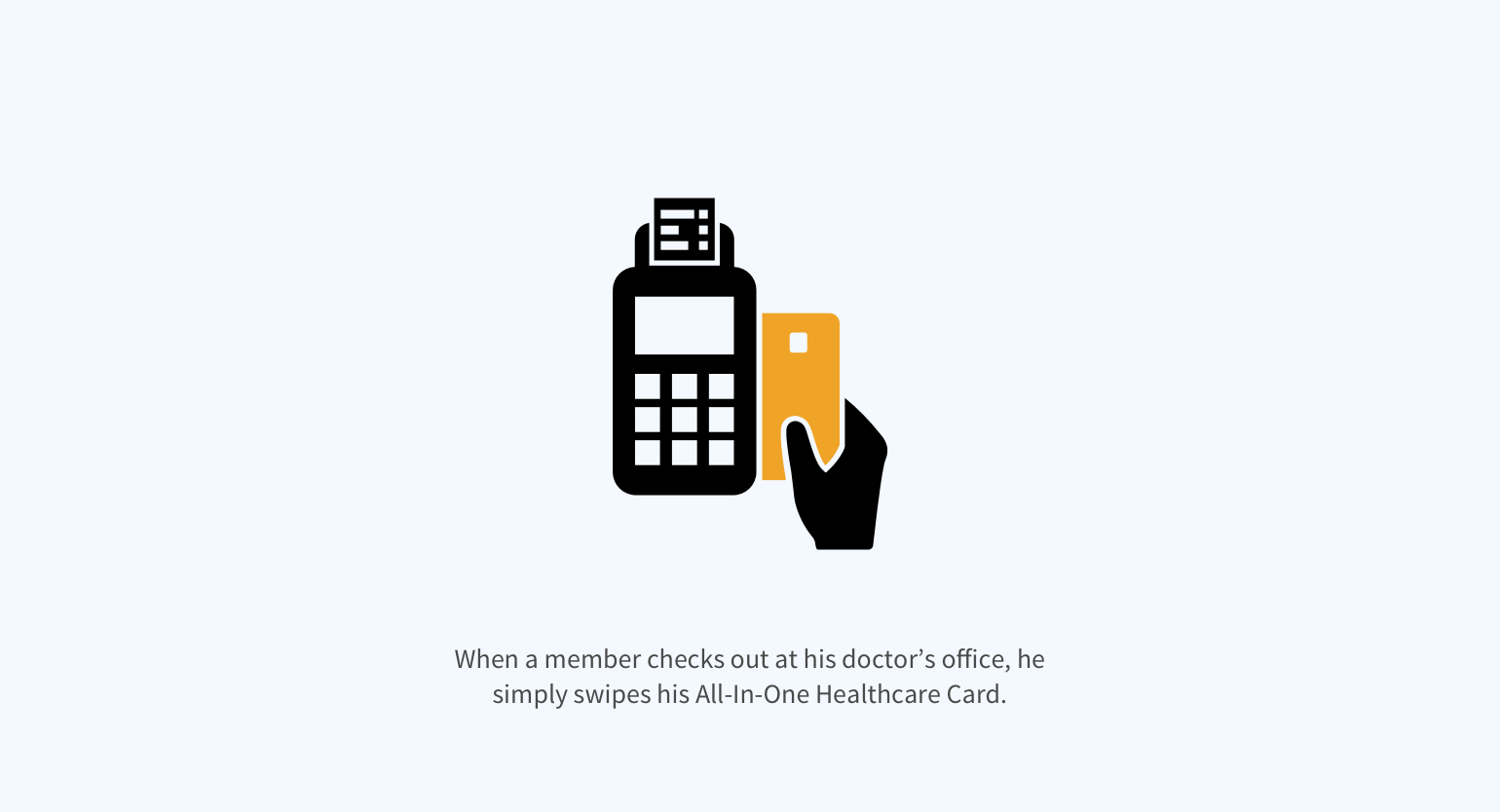

Whenever a member pays with his Healthcare Card at the doctor’s office, this transaction creates a touchpoint for the insurance administrator to facilitate documenting medical procedures, which can benefit the member in several ways.

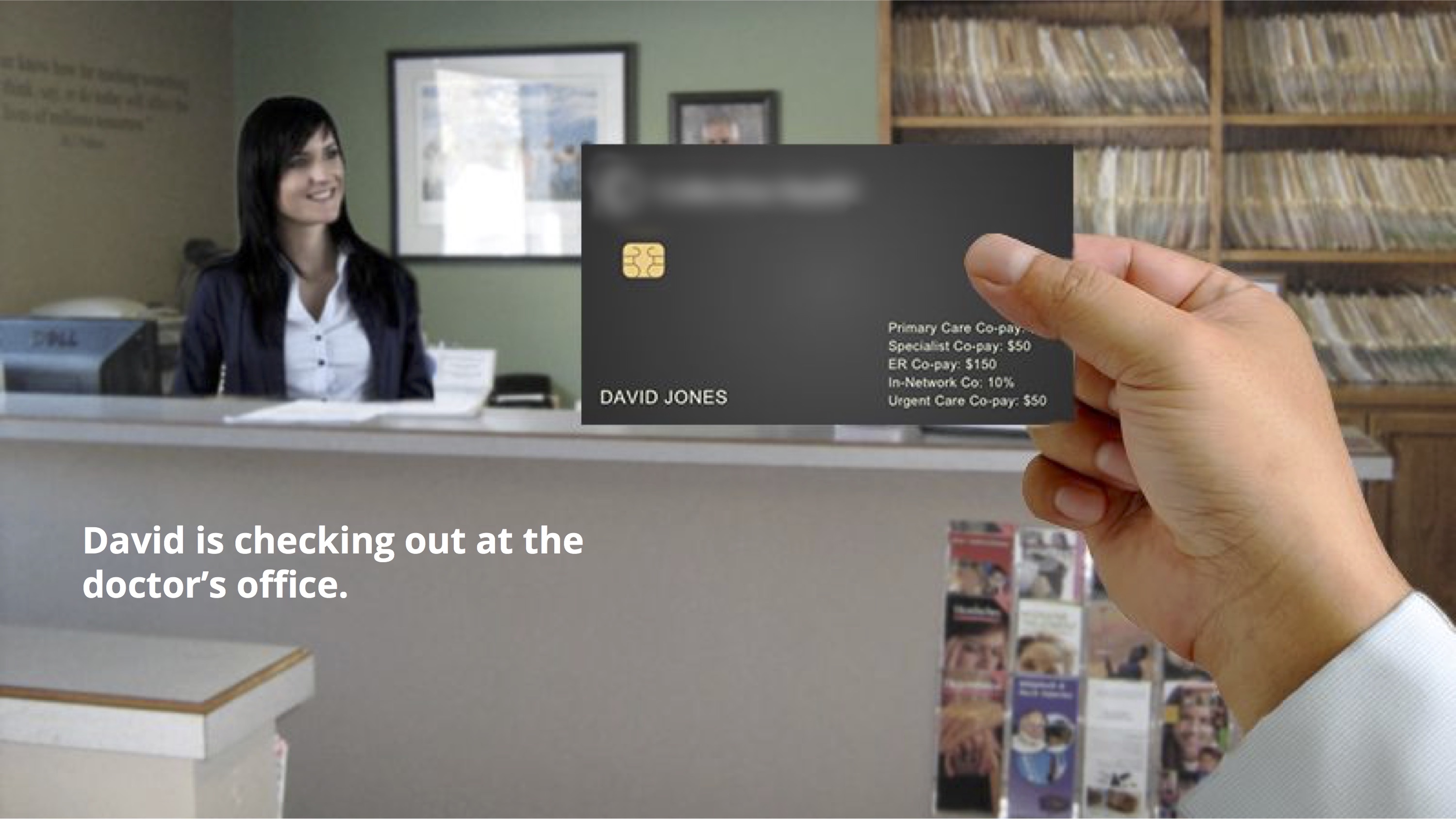

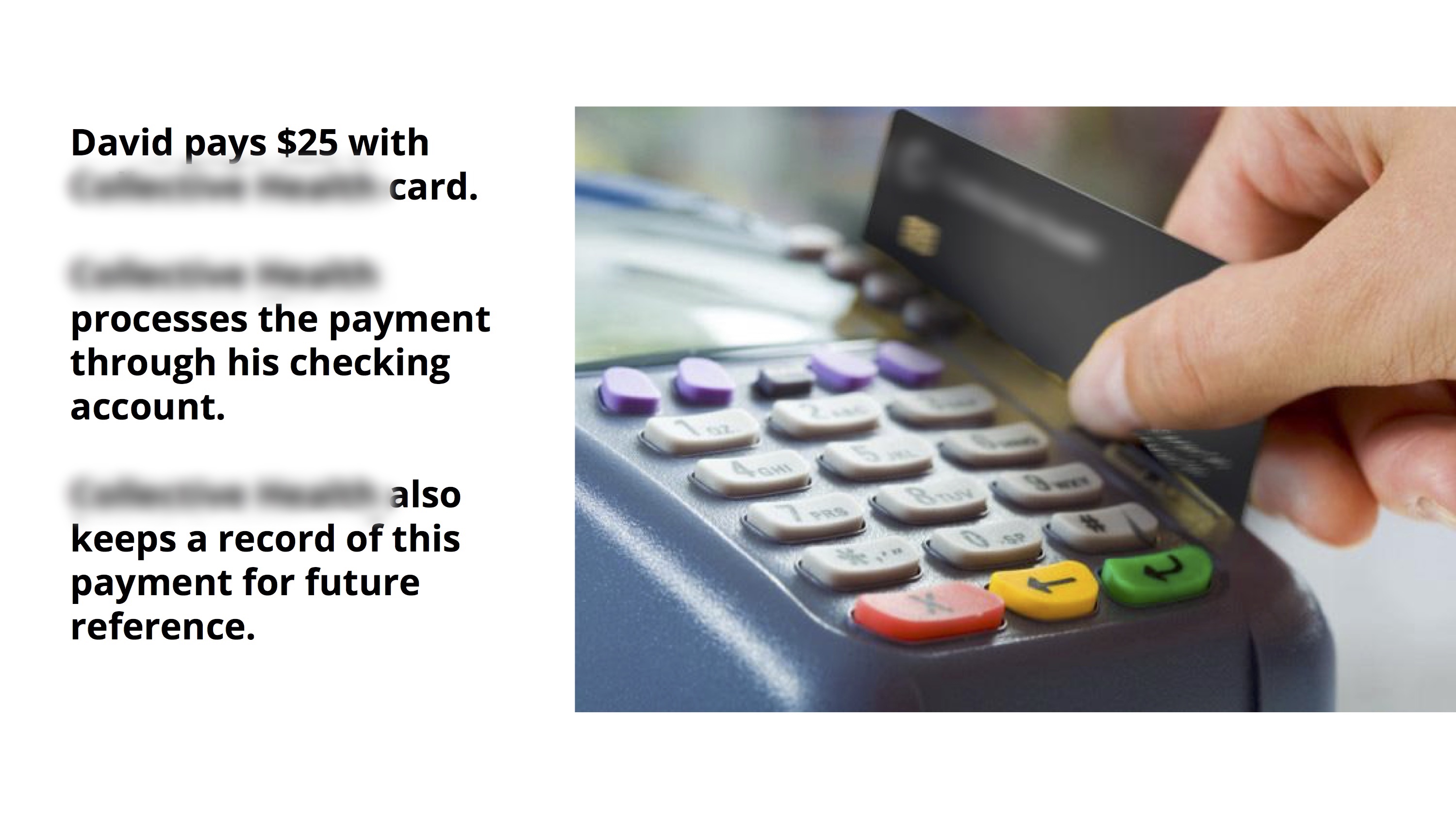

Pitching to the client

We put together a cohesive user story to illustrate the member experience that our concept would support, and how it addressed our client’s ask.

Iteration: based on client's feedback

After getting client’s feedback from the pitch, we did another round of rapid iteration before presenting to the client again in two days.

Client's feedback

Behavioral change

Introducing the All-in-One Healthcare Card to members will change their behaviors in many ways. How can we ensure a smooth transition into the new behaviors?

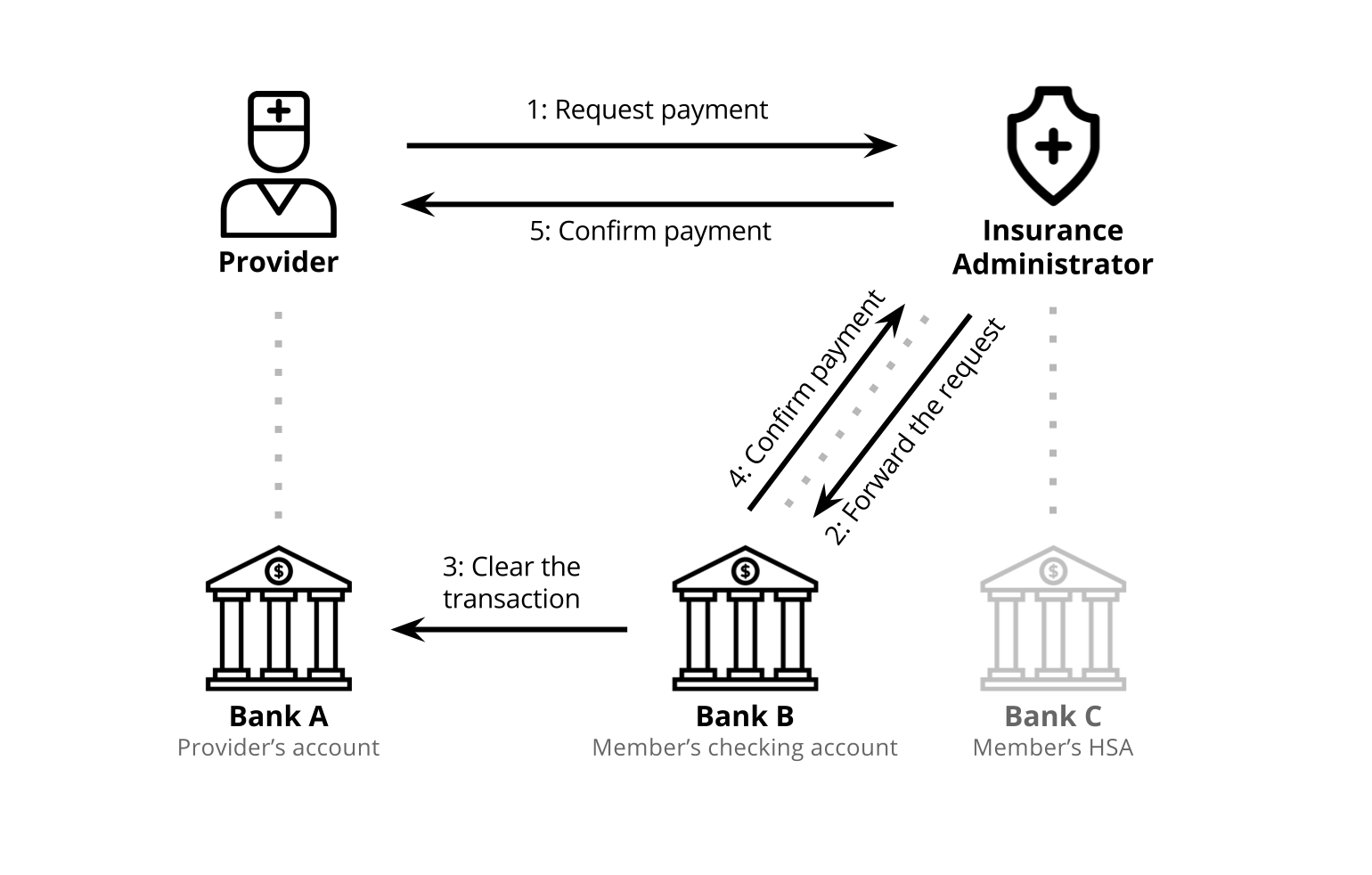

Financial system

To implement this All-in-One Healthcare Card, will the insurance administrator become a financial institution? How does this new card work within the current financial system?

Iteration 1: Introducing the new card

In response to the behavioral change issue, we thought about how to guide members to adopt the new card one step at the time. In the first step — deliverying the new card — we used this booklet to explain to members: what is this new card, how it can be useful, and how to set it up.

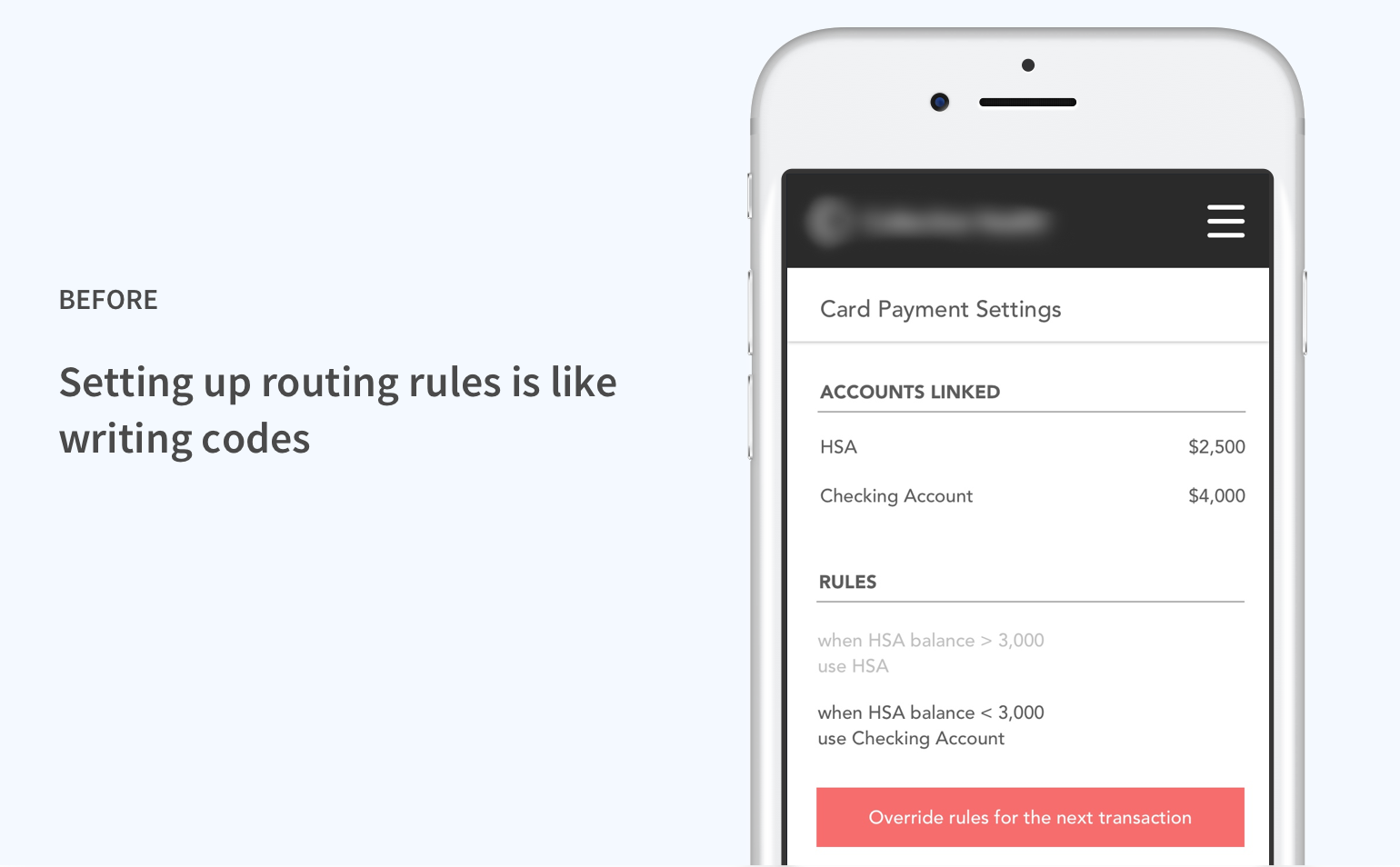

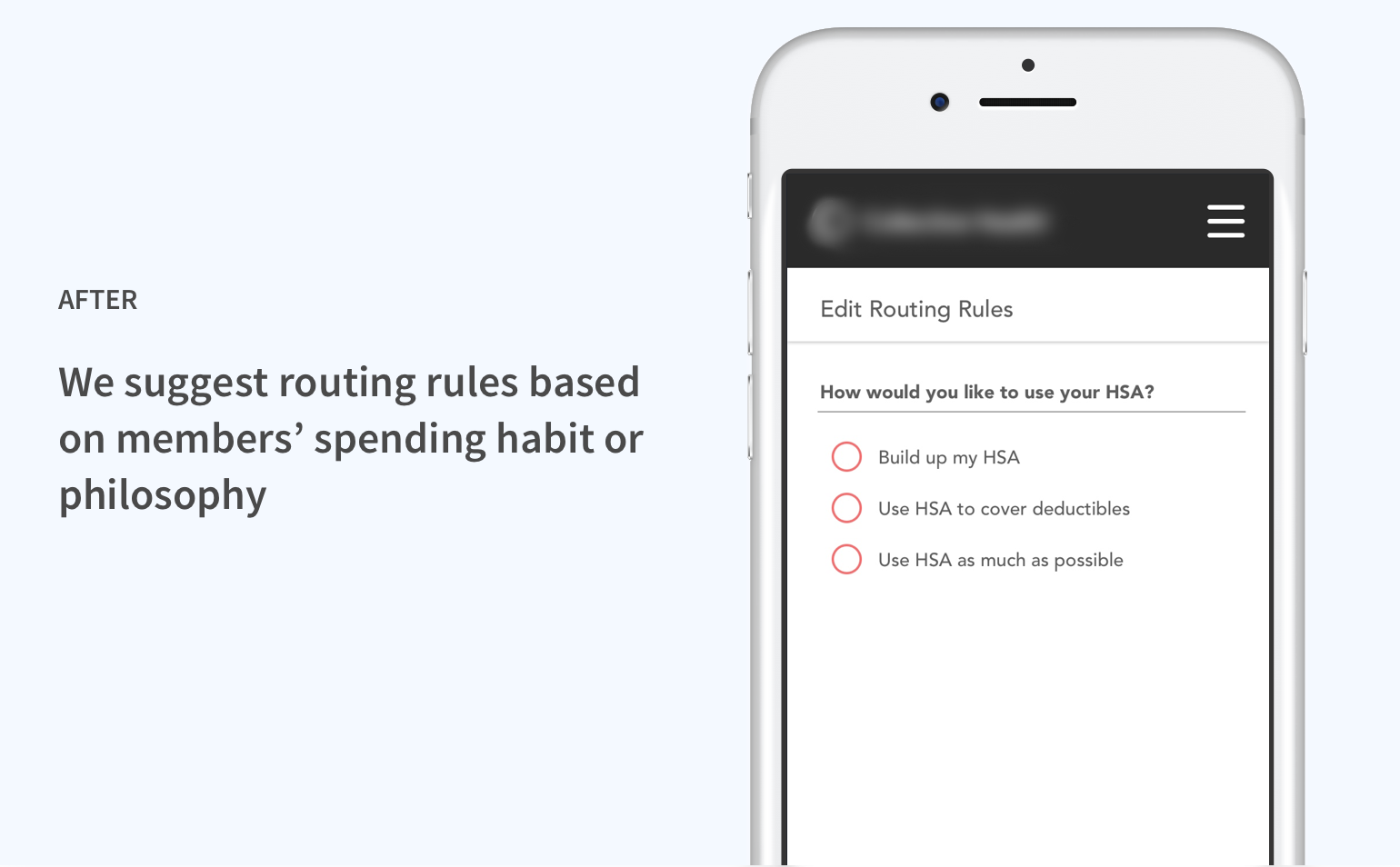

Iteration 2: Connecting rules with spending patterns

Also in response to the behavioral change issue, we reconsidered our approach to enabling members to specify payment methods.

Iteration 3: Operating within the financial system

We understand that becoming a financial instituion or credit card company is risky for our client and not in line with their business goal, so we figured out a way to make the new card work within the constrains of the current financial system.

More work

From complaints to happier customers and better productsdiscovery | experience strategy | 2019

Navigate Complexity: Nationwide Financial Website Redesigngenerative | evaluative | concurrent projects | 2018

Design for Autism: Empowerment, Awareness, and Acceptancegenerative | co-design | research through design | 2017

Health Insurance Simplifiedgenerative | experience design | 2016

© 2019 Yiying Yang